Add/Edit Company and Employee Deductions

We’ve made the experience of adding and editing deductions at the company and employee levels more intuitive, adding validations that will help prevent errors to your deduction setup and potential issues at tax time.

COMPANY AND EMPLOYEE DEDUCTIONS

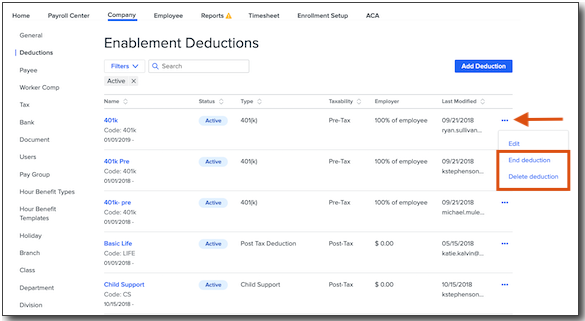

Continuing to iterate on recent updates to the Company Deductions and Employee Deductions pages, we’ve added the ability to end-date and delete deductions from the deduction list view.

To edit, end-date, or delete a deduction at the company or employee levels:

-

Go to Company > Deductions or Employee > (select employee) > Deductions.

-

Click the menu icon next to the deduction.

-

Select Edit to make changes to an existing deduction.

-

Select End deduction to end-date the deduction.

-

End-dated deductions cannot be used in any pay cycles processed after the entered end date. End-dating a company-level deduction will also end-date any associated employee-level deductions.

-

-

Select Delete deduction to remove the deduction entirely.

-

Deductions that have been used in a pay cycle can’t be deleted. Deleted deductions can’t be recovered.

-

-

Note: Employees with read-only access to Payroll will not be able to edit, end, or delete deductions.

For more information on deduction filters, searching for deductions, and columns in the deductions list, visit Company Deductions and Employee Deductions.

ADDING A DEDUCTION

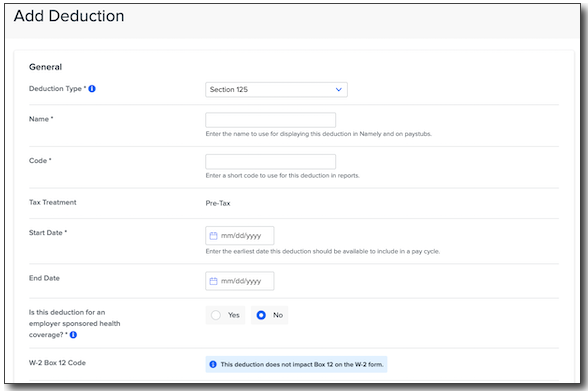

To add a deduction at the company or employee level, click Add Deduction.

WHAT'S CHANGED AT THE COMPANY LEVEL

On both the Company and Employee Deduction pages, the fields displayed are now dynamic—meaning you’ll only see fields relevant to the specific type of deduction you are adding.

For example, when adding company-level deductions, you’ll only be able to note that a deduction is for Employer Sponsored Health Coverage on section 125, post-tax deductions, and domestic partner benefits.

At the Company level, the following fields have been removed due to lack of use and/or relevancy:

-

General Ledger Name

-

General Ledger Code

-

Override Allowed

-

Minimum Annual Amount

Additionally, we’ve renamed a number of fields to provide a clearer explanation of the behavior they govern.

-

Please note: New field names will not be reflected in any Custom Reports.

|

Previous Field Name |

New Field Name |

|

Deduction Code |

Code |

|

Deduction Name |

Name |

|

W-2 Mapping - Is an Employer Sponsored Health Coverage Deduction |

Is this deduction for an Employer Sponsored Health Coverage? |

|

Automatic Payment |

Do you want Namely to remit payment on your behalf? |

|

Amount Type |

% or $ dropdown menu |

|

Amount Per Pay Period |

Cost Per Pay Period |

|

Cap Amount Type |

% or $ dropdown menu |

|

Cap Amount Per Pay Period |

Maximum Per Pay Period |

|

Annual Maximum |

Maximum Per Year |

Additional changes at the company level include:

-

Costs for garnishments and loans can no longer be set at the company level, only the employee level.

-

FSA/HSA amounts can only be entered in dollar amounts, not percentages.

-

The Deduction Code must be unique. It cannot be used on multiple deductions.

-

The field formerly labeled Is this deduction for an Employer-Sponsored Health Coverage will only appear if the deduction type is section 125, post-tax deductions, and domestic partner benefits.

-

You will now be able to see the W-2 Box 12 code for the deduction.

EARNINGS AND IMPUTED INCOME

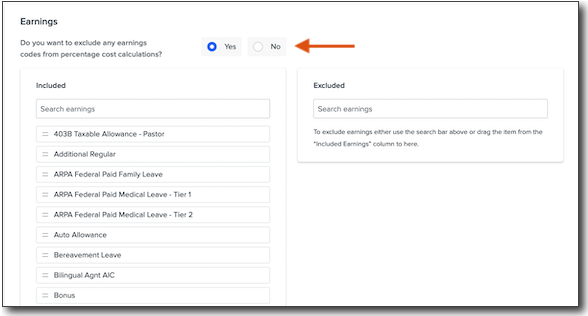

You can easily exclude specific earnings (pay types) from percentage cost calculations for a deduction.

-

Under Earnings, select Yes when asked Do you want to exclude any earnings codes from percentage cost calculations.

-

You can either drag and drop specific earnings from the Included column to the Excluded column, or search for earnings in either column to add them there.

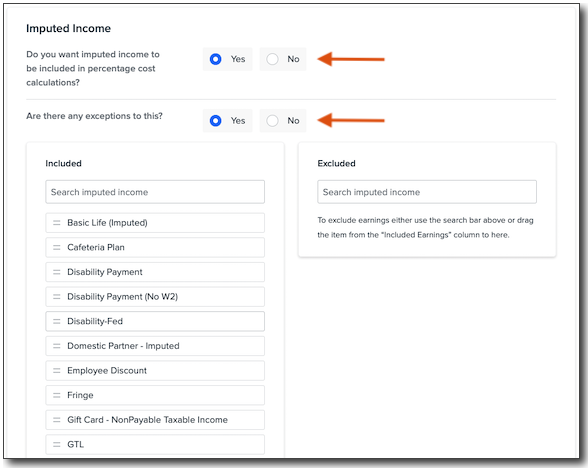

To include imputed income in percentage cost calculations for a deduction:

-

Under Imputed Income, select Yes when asked Do you want imputed income to be included in percentage cost calculations.

-

If there are any exceptions, you can either drag and drop the imputed income types from the Included column to the Excluded column, or search for specific imputed income in either column.

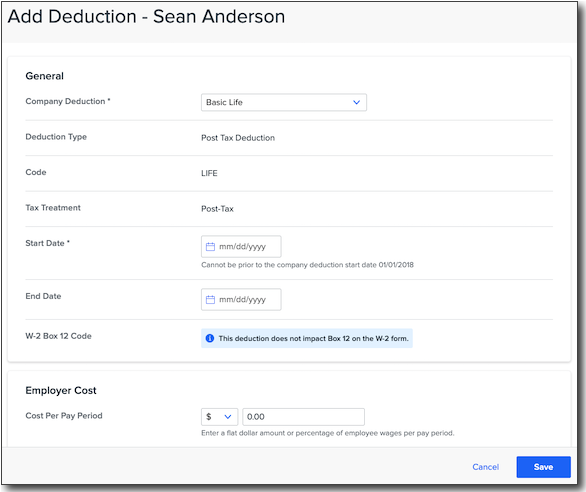

WHAT'S CHANGED AT THE EMPLOYEE LEVEL

Similarly to on the Company Deductions page, fields on the Employee Deductions page are now displayed dynamically depending on the specific deduction type you’re assigning to an employee.

Specific changes at the employee level include:

-

The Priority Processing field has been removed from all deduction types as it is no longer relevant.

-

Once a loan deduction type has been added, the starting balance cannot be modified. If you need to change the starting balance, you must end-date the current deduction and create a new one.

-

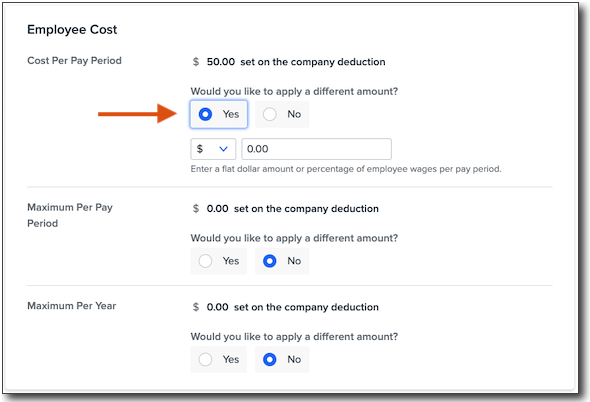

Employee and employer costs will display the associated cost set at the company level. Select Yes to apply a different amount.

-

FSA/HSA amounts can only be entered in dollar amounts (no percentages).

-

Employer costs can no longer be added for garnishment and loan deduction types—only employee costs.

-

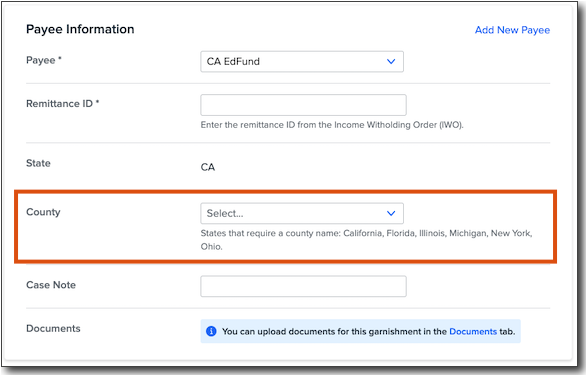

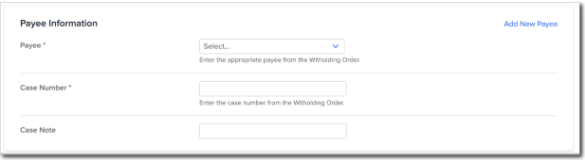

Garnishments with Automatic Payment selected at the company level will include a Payee Information section and required Payee and Case Number fields.

-

You can add a new payee without navigating away from the page by clicking Add New Payee.

-

-

Only child support payees will be available to be selected as payees for child support deduction types.

-

Child Support deduction types will include a new, required County field if the payee is in California, Florida, Illinois, Michigan, New York, or Ohio.